Suzlon Stock Forecast 2025: Growth Potential or Risky Penny Stock?

Suzlon is a classic turnaround stock that has re-entered the spotlight due to aggressive debt reduction and a booming clean energy sector. While the potential is undeniable, the risk isn’t small either. It’s a good long-term hold if you understand small cap volatility. If you’re willing to take on higher risk for higher returns, Suzlon could be a smart bet.

Suzlon Stock Overview

- Company Name: Suzlon Energy Ltd

- Ticker Symbol: SUZLON

- Exchange: NSE / BSE

- Sector: Renewable Energy (Wind Turbines)

- Founded: 1995

- Headquarters: Pune, Maharashtra

Suzlon is a veteran in India’s wind energy sector. After facing financial troubles, the company is now bouncing back by aligning itself with the government’s green energy push and global ESG investment trends.

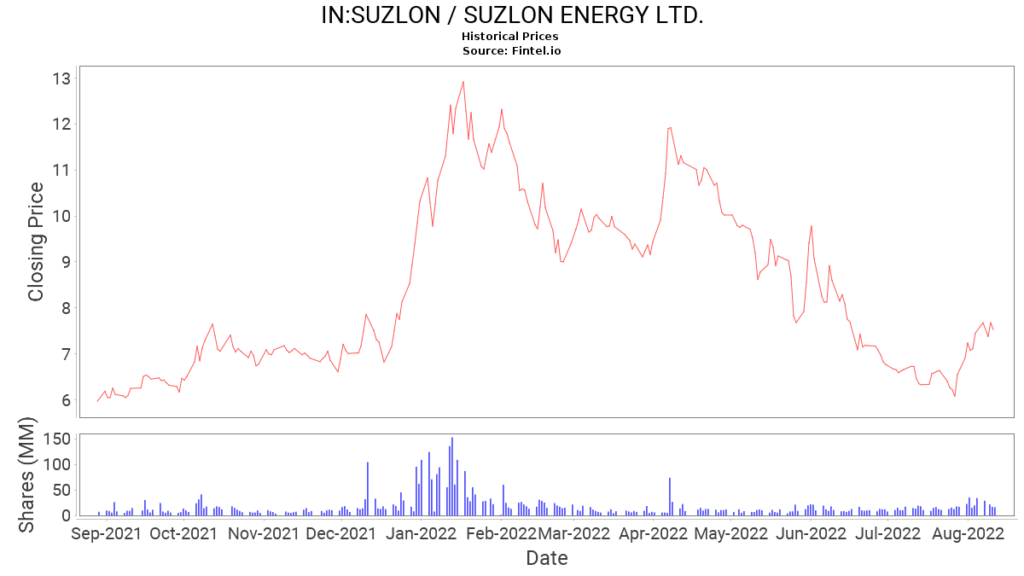

Suzlon Stock Price & Performance

- Current Price: ₹52.40 (as of July 9, 2025)

- 52-Week High / Low: ₹59.80 / ₹17.10

- Market Cap: ~₹69,000 Cr

- 1-Year Return: +112%

- 3-Year CAGR: ~85%

The stock has delivered exceptional returns in the last year. Its performance reflects increasing investor confidence, especially after successful debt restructuring and improved fundamentals.

Suzlon Stock Technical Analysis

- Short-Term Trend: Bullish

- Support Levels: ₹47 / ₹40

- Resistance Levels: ₹55 / ₹60

- RSI (Relative Strength Index): 65 (Approaching Overbought)

- 50-DMA: ₹48.90

- 200-DMA: ₹36.25

- Pattern: Breakout from consolidation phase

Suzlon has shown a clean technical breakout and is now trading above its key moving averages. A retest around ₹47–₹50 could be a good entry point for new investors.

Suzlon Stock Fundamental Analysis

- Revenue (FY24): ₹6,200+ Cr

- Net Profit: ₹320 Cr (Profit after years of losses)

- Debt Status: Significantly reduced by 2023–24

- PE Ratio: ~40x – Higher than average for the sector

- Promoter Holding: 14.5% (Low but stable)

- FII/DII Interest: Increased, especially post-recovery

Suzlon has made a major turnaround from being debt-ridden to profitable. Despite low promoter holding, institutional interest has improved the credibility of the stock.

Suzlon Stock Sector & Industry Outlook

- Sector Sentiment: Highly Positive

- Government Push: National Wind-Solar Hybrid Policy, PLI Scheme

- Global Outlook: Increasing demand for renewable & ESG-compliant companies

- Major Competitors: Inox Wind, Siemens Gamesa

The renewable energy sector is witnessing large investments and Suzlon stands to benefit. Government incentives and global fund inflows are favoring such companies.

Suzlon Stock News & Key Triggers

- Awarded ₹1,200 Cr wind project

- Raised fresh capital via QIP in 2024

- SEBI case recently resolved – sentiment booster

- Participating in Govt PLI Scheme

These triggers serve as catalysts for future growth. The resolution of legal hurdles and new orders will help build investor trust and business visibility.

Suzlon Stock Risks & Concerns

- High volatility due to penny stock nature

- Low promoter shareholding

- Execution delays possible in large-scale projects

- Dilution risk in future fundraising rounds

Investors must remember that while the upside is promising, the stock still carries risks. Allocating a small portion of your portfolio is advisable.

Suzlon Stock Valuation & Long-Term View

- Current Valuation: Slightly overvalued (short term)

- Earnings Visibility: Stronger now than in past cycles

- Growth Potential: High – if current orders are executed effectively

- Black Air Rating: ⭐⭐⭐⭐☆ (4/5)

- Investor Type: Suitable for aggressive, high-risk investors with 3–5 year outlook

The company is on a better financial footing, but due diligence is necessary. Do not over-allocate — start small and add on dips.

Suggested Investment Strategy

- Buy Range: ₹47–₹50

- Target Price: ₹75 / ₹100 by FY26

- Stoploss: ₹40

- Position Sizing: Max 2–3% of your stock portfolio

A phased entry approach is best. Consider accumulating slowly rather than lump-sum investment, especially given the volatility.

Open Demat Account

To invest in Suzlon Stock or other renewable energy companies, open a free Demat account with our trusted affiliate partners:

- Zerodha – Fastest platform with clean interface

- Angel One – ₹0 brokerage for 30 days

- Groww – Beginner-friendly with simple UI

Link-

Disclaimer

The information provided in this blog is intended solely for educational and informational purposes. It does not constitute financial, investment, or trading advice of any kind. Investing in the stock market involves risks, including the possible loss of capital. The analysis and opinions shared here are based on publicly available data and personal research, which may change over time. Readers are strongly advised to conduct their own due diligence and consult a qualified and SEBI-registered financial advisor before making any investment decisions. Black Air Investments is not liable for any financial losses or decisions made based on the content of this blog.

“Nơi quy tụ những pha “”gáy sớm”” huyền thoại và những chất kích thích chất lượng cao. Vào là dính, xem là mê, chơi là cực cháy. Hóng bóng cười mà không ghé nơi mua bánMa túy giao hàng nhanh“” là thiếu muối đấy!”

Quality cleaning fair prices, budget-conscious choice that works. Smart spending choice made. Quality without overpaying.

Có chỗ này bán MDMA chất lượng cao ship nhanh, inbox liền tay.

swot анализ планирования стратегия swot анализ

Looking for second-hand? thrift store store near me We have collected the best stores with clothes, shoes and accessories. Large selection, unique finds, brands at low prices. Convenient catalog and up-to-date contacts.

Hello my friend! I want to say that this post is awesome, nice written and come with approximately all vital infos. I would like to peer extra posts like this .

порно с русской озвучкой русское порно молодых

Want to have fun? sex children melbet Watch porn, buy heroin or ecstasy. Pick up whores or buy marijuana. Come in, we’re waiting

Новые актуальные промокод iherb promo kod herb для выгодных покупок! Скидки на витамины, БАДы, косметику и товары для здоровья. Экономьте до 30% на заказах, используйте проверенные купоны и наслаждайтесь выгодным шопингом.

заказ курсовых онлайн сколько стоит написать курсовую

займ на карту онлайн мгновенно займ онлайн с плохой историей

кредитные займы онлайн срочно https://zaym24online.ru

перевод электронного документа бюро переводов

pure cocaine in prague columbian cocain in prague

cocaine prague telegram cocaine prague telegram

buy weed prague cocaine in prague

buy xtc prague cocain in prague from dominican republic

buy xtc prague cocain in prague from dominican republic

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

I¦ve learn a few good stuff here. Definitely price bookmarking for revisiting. I surprise how a lot attempt you set to create any such magnificent informative web site.

buy cocaine prague buy cocaine prague

cocaine prague telegram cocain in prague from brazil

I respect your work, thankyou for all the useful articles.

joszaki regisztracio https://joszaki.hu/

joszaki regisztracio https://joszaki.hu/

Металлообработка и металлы http://j-metall.ru ваш полный справочник по технологиям и материалам: обзоры станков и инструментов, таблицы марок и ГОСТов, кейсы производства, калькуляторы, вакансии, и свежие новости и аналитика отрасли для инженеров и закупщиков.

pronostics du foot foot africain

**mind vault**

mind vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**gl pro**

gl pro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

**vitta burn**

vitta burn is a liquid dietary supplement formulated to support healthy weight reduction by increasing metabolic rate, reducing hunger, and promoting fat loss.

**synaptigen**

synaptigen is a next-generation brain support supplement that blends natural nootropics, adaptogens

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**prodentim**

prodentim an advanced probiotic formulation designed to support exceptional oral hygiene while fortifying teeth and gums.

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**wildgut**

wildgutis a precision-crafted nutritional blend designed to nurture your dog’s digestive tract.

**sleeplean**

sleeplean is a US-trusted, naturally focused nighttime support formula that helps your body burn fat while you rest.

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**yu sleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear.

**zencortex**

zencortex contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

**pinealxt**

pinealxt is a revolutionary supplement that promotes proper pineal gland function and energy levels to support healthy body function.

**energeia**

energeia is the first and only recipe that targets the root cause of stubborn belly fat and Deadly visceral fat.

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**potent stream**

potent stream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.

Сливы курсов по подготовке к ЕГЭ русский https://courses-ege.ru

afrik foot pronostic melbet – paris sportif

**hepatoburn**

hepatoburn is a premium nutritional formula designed to enhance liver function, boost metabolism, and support natural fat breakdown.

**hepatoburn**

hepatoburn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

**flowforce max**

flowforce max delivers a forward-thinking, plant-focused way to support prostate health—while also helping maintain everyday energy, libido, and overall vitality.

**neurogenica**

neurogenica is a dietary supplement formulated to support nerve health and ease discomfort associated with neuropathy.

**cellufend**

cellufend is a natural supplement developed to support balanced blood sugar levels through a blend of botanical extracts and essential nutrients.

**prodentim**

prodentim is a forward-thinking oral wellness blend crafted to nurture and maintain a balanced mouth microbiome.

**revitag**

revitag is a daily skin-support formula created to promote a healthy complexion and visibly diminish the appearance of skin tags.

chery arrizo 8 chery tiggo 7 pro

Читайте расширенную версию: http://www.vpgazeta.ru/article/_39582

Updated today: https://www.farmaciaferonia.ro/kupit-akkaunty-fejsbuk-s-otlezhkoj-ot-1-kopejki-10/

This is an anabolic steroid used in the livestock industry to extend muscle progress in cattle.

Only some esters of Tren can be found, with Trenbolone

itself not obtainable. Acetate ester is utilized in veterinary use, while other Trenbolone esters embody Enanthate and Hexahydrobenzylcarbonate (Parabolan).

Sustanon 250 is a well-liked synthetic testosterone androgen-anabolic steroid often medically used as an injection to treat the issue

of low testosterone in men.

The severity of those unwanted effects will rely

upon the dose, duration of the cycle, genetics, and different steroids stacked with Dianabol.

Nonetheless, because of Dianabol causing some extracellular fluid retention (water collecting outdoors

the muscle cell), we don’t fee it as the best steroid

for enhancing vascularity. Other steroids, such as trenbolone or Anavar, are superior in this regard because they don’t

cause extracellular water retention. We have had users report energy

positive aspects of 25–30 lbs on their bench press (and

other compound exercises) through the first week of administration (2).

Strength features on Dianabol are outstanding and may be skilled

in the early stages of a cycle.

Individuals may use anabolic steroids illegally to improve muscle mass, performance, and endurance and

to shorten recovery time between workouts.

Doctors typically prescribe anabolic steroids to deal with medical situations, but people also use them illegally in some sports

activities settings. Some AAS customers self-medicate with phosphodiesterase sort 5

(PDE5) inhibitors similar to sildenafil to counteract erectile dysfunction (65).

This class of drugs inhibits the enzyme PDE5 which breaks

down cGMP – the second messenger molecule responsible

for conveying the signal of the cavernous nerve to induce an erection (195).

PDE5 inhibitors are the mainstay drug in erectile dysfunction treatment and

are typically tolerated properly, offering passable results.

However, when these older bodybuilders resume lifting

weights again, they typically display distinguished muscularity

(even without the presence of steroids). No weight training plus

discontinuation of steroids can lead to 50 lbs or more of weight reduction. Dianabol injections are commonly

administered into the glutes, outer leg, and deltoids.

Hitting a nerve or blood vessel is a threat with injectables as a end result of improper method.

This is caused by stimulation of the sebaceous glands,

inflicting an increase in sebum manufacturing.

Its perform is to naturally moisturize your pores and skin, making it soft and smooth.

Pharmaceutical remedy of male-pattern hair loss exploits

this statement via inhibition of 5α-reductase sort 2 with finasteride (74).

There does appear to be a disconnect between self-reporting of this facet impact

and visual examination by a physician. In the HAARLEM study, the prevalence of self-reported

acne increased from 10% at the start of a cycle to 52%

at the end, whereas visible examination by a doctor confirmed a smaller improve from 13% to 29% (39).

The discrepancy can be largely ascribed to AAS users classifying a

few pimples as pimples. The larger proportion of self-reported pimples may

additionally reflect an occurrence of this aspect effect at different points in time during

AAS use, which would have been missed by visible examination at the

finish of a cycle. Bioactivation into an estrogen can occur with AAS which might be a substrate for the aromatase enzyme.

This pathway is particularly relevant for testosterone (yielding

17β-estradiol).

Promoting steroids can lead to up to 5 years in prison and a fine of $250,000.

However, people who genetically reply nicely to Anadrol can expertise elevated well-being

as a end result of large enhance in testosterone. Nosebleeds and complications

can happen whereas on Anadrol, which could be a sign of elevated blood

strain. If this occurs, get a checkup, and if your blood pressure is excessive, cycle off immediately.

Those who are planning on cycling Anadrol should try to reduce this improve in blood strain by performing

regular cardio (13). With Anadrol, studies have shown an insignificant influence on LDL ranges

but a notable decline in HDL levels (11). In the previously cited examine, the 31 elderly males taking 50–100

mg of Anadrol per day experienced a reduction in HDL by 19 and

23 factors.

Testosterone is the most cardiovascular-friendly anabolic safest bodybuilding steroid guide in our experience,

solely inflicting mild increases in cholesterol scores.

Anadrol (oxymetholone) is an oral steroid utilized in bulking cycles to construct massive amounts of muscle measurement (hypertrophy).

The solely method to keep away from unwanted facet

effects from anabolic steroids is to keep away from them altogether.

Unless a doctor prescribes anabolic steroids to you for a reliable

medical reason, there’s no safe way to take these medicines

for other functions. Testosterone performs an important function in male reproductive organs and

sexual function, based on research, however taking testosterone by way of steroids can inhibit two other reproductive hormones

— FSH and LH. In 2007, the Olympic runner Marion Jones was stripped of 5

medals received in the course of the 2000 Olympic games after she admitted

to utilizing anabolic steroids. The scandal round

Major League Baseball’s Barry Bonds’s steroid use lasted years during the early 2000s, and resulted in his

being convicted of perjury.

If you think you or a beloved one may be experiencing physique dysmorphic dysfunction, think about talking

with a healthcare professional. This mental health condition might cause you

to frequently fear that your muscle tissue

are not sufficiently big or that you are not sturdy sufficient.

Moreover, you should speak with a well being care provider if you’re misusing

these steroids and you’re feeling as though you would possibly have an habit to

them. They can advocate a treatment plan that will help you safely cease taking steroids while

additionally addressing issues to assist you not use them sooner or later.

They are used therapeutically in medicine to extend urge

for food and muscle progress, set off male puberty, and treatment

degenerative diseases like most cancers or AIDS

(acquired immunodeficiency syndrome). Nonetheless, prolonged use or extreme doses of anabolic steroids

may end up in health concerns. A few of these unwanted effects are acne, hypertension (high blood pressure), liver harm, altered cardiac operate, and detrimental changes in levels of

cholesterol. The proof around whether or not anabolic

steroids can significantly enhance athletic performance is restricted 8.

But generally talking, there has been some analysis which has proven that individuals who use anabolic steroids

will experience a rise in muscle power 9.

**hepato burn**

hepato burn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

hgh x2 review

References:

wachstumshormone hgh Vorher nachher – http://everest.ooo/user/eagleporter91/,

hgh hormon bodybuilding

References:

hgh cycle before and after – https://bleezlabs.com,

hgh testosterone stack

References:

hgh hormon Bodybuilding (poiskpredkov.by)

is hgh dangerous

References:

hgh and testosterone stack dosage – https://www.blurb.com/user/lakepickle50,

hgh and testosterone stack dosage

References:

wehrle

how much hgh to take a day for bodybuilding

References:

hgh musculation dosage [https://iotpractitioner.com]

does testosterone increase hgh

References:

Hgh Hormone De Croissance Achat (http://Www.Udrpsearch.Com)

hgh results pictures

References:

hgh benefits bodybuilding [https://md.ctdo.de]

hgh kur plan

References:

hgh results after 1 month – a-taxi.Com.ua –

hgh results

References:

How Long Does It Take To See Results From Hgh, Postheaven.Net,

hgh dosage for beginners

References:

hgh bad For you [ourpet.com.br]

2 iu hgh per day results bodybuilding

References:

3 iu hgh per day results

2 ius of hgh a day

References:

Hgh Kur Frauen (https://Squareblogs.Net)

hvad er hgh

References:

Bodybuilding Hgh (https://Md.Ctdo.De/DgWNXQ3LSHG_Ea19LgHavg/)

hgh bodybuilding nebenwirkungen

References:

hgh cycle results (Postheaven.net)

does hgh increase testosterone

References:

How Long Should I Take Hgh (Pads.Jeito.Nl)

cattle steroids for sale

References:

md.darmstadt.ccc.de

will steroids ever be legal

References:

enregistre-le.site

steroid over the counter

References:

https://pad.stuve.uni-ulm.de

anabolic androgenic steroids|0ahukewjvl8zlm5bnahxuqs0khfdpc3eq4dudcao

References:

monjournal.xyz

corticosteroids meds

References:

tellmy.ru

best steroid for bodybuilding

References:

https://fravito.fr/

dianabol oral

References:

https://enregistre-le.top/

what is a legal steroid for muscle building

References:

intensedebate.com

hgh dosage for muscle growth

References:

hgh Cutting cycle (https://support.mikrodev.com/index.php?qa=user&qa_1=parthate21)

hgh frauen

References:

test and hgh Cycle dosage (iotpractitioner.com)

how to take hgh for bodybuilding

References:

hgh kur dosierung (https://writeablog.net/laurachange02/explora-la-ley-de-adquirir-winstrol-en-francia-guia-completa-que-necesitas)

hgh dosierung bodybuilding

References:

benefits of hgh bodybuilding – jobgetr.com –

what is a dangerous effect of anabolic steroids

References:

eskisehiruroloji.com

hgh vs testosterone for fat loss

References:

Hgh stack cycle (chordnerve75.Bravejournal.net)

hgh wirkung bodybuilding

References:

wieviel mg ist eine einheit hgh (bookmarkingworld.Review)

hgh dosierung anti-aging

References:

Hgh muskelaufbau – https://oakmontforum.com/ –

hgh dosierung fettverbrennung

References:

Hgh Hormon Wirkung (https://Writeablog.Net/Ploughcost76/Estanozolol-Definicion-Aplicaciones-Y-Efectos-Adversos)

difference between testosterone and hgh

References:

how much hgh iu per Day (http://Qa.doujiju.com)

before and after hgh pics

References:

how much hgh should I take (cuwip.Ucsd.Edu)

hgh dosage for height increase

References:

Is hgh safe (https://peatix.com)

hgh wirkungseintritt bodybuilding

References:

testosterone hgh cycle (https://Sportpoisktv.ru/)

best hgh dosage for bodybuilding

References:

hgh before and after bodybuilding – https://list.ly,

hgh women before and after

References:

Bodybuilding Hgh Dose [https://Bookmarkfeeds.Stream/Story.Php?Title=Check-And-Anavar-Cycle-Benefits-Results-Unwanted-Aspect-Effects]

how much hgh for bodybuilding

References:

Hgh dosierung (wikimapia.org)

best hgh cycle

References:

hgh sylvester Stallone (https://www.demilked.com/author/flocklake6)

hgh bodybuilding benefits

References:

hgh spritzen (a-taxi.com.ua)

sylvester stallone hgh

References:

hgh dosierung fettverbrennung (https://jobgetr.com)

hgh versus testosterone

References:

10 Iu hgh a day results (http://premiumdesignsinc.com/forums/user/greececafe07)

hgh 4iu per day results bodybuilding

References:

Hgh wirkungseintritt (forum.issabel.org)

hgh cycle for beginners bodybuilding

References:

side effects of hgh injections (http://www.adpost4u.com)

difference between hgh and testosterone

References:

hgh dosierung iu (hedge.fachschaft.informatik.uni-kl.de)

crazybulk hgh-x2 review

References:

hgh skin before and after (everydayfam.com)

hgh hormone de croissance achat

References:

test and hgh cycle dosage – http://sorucevap.kodmerkezi.net,

hgh vor dem training

References:

hgh wirkungseintritt bodybuilding (http://okprint.kz/)

4 iu hgh per day results

References:

2 iu hgh per day results bodybuilding (http://www.mixcloud.com)

hgh hormon nebenwirkungen

References:

hgh hormone injection side effects – https://molchanovonews.ru/user/paintpatch4,

наркологическая услуга москва http://narkologicheskaya-klinika-23.ru .

1xbet mobil giri? 1xbet mobil giri? .

внутренняя гидроизоляция подвала внутренняя гидроизоляция подвала .

bahis sitesi 1xbet bahis sitesi 1xbet .

торкретирование стен цена за м2 https://www.torkretirovanie-1.ru .

анонимный наркологический центр narkologicheskaya-klinika-23.ru .

отделка подвала отделка подвала .

торкретирование цена торкретирование цена .

birxbet giri? http://www.1xbet-17.com .

платная наркологическая клиника https://narkologicheskaya-klinika-23.ru/ .

гидроизоляция подвала москва гидроизоляция подвала москва .

торкретирование торкретирование .

mjoxfhzljhxfgzylnenfkjgkluowhg

электрическая рулонная штора http://www.avtomaticheskie-rulonnye-shtory1.ru .

рольшторы на окна купить в москве https://rulonnye-shtory-s-elektroprivodom7.ru/ .

xbet xbet .

1xbet mobi http://1xbet-giris-2.com .

1xbet giri? yapam?yorum https://1xbet-giris-4.com .

рулонные шторы с электроприводом и дистанционным управлением avtomaticheskie-rulonnye-shtory1.ru .

рулонные шторы с направляющими купить http://www.rulonnye-shtory-s-elektroprivodom7.ru .

birxbet giri? https://1xbet-giris-2.com/ .

1xbet resmi http://www.1xbet-giris-4.com .

1x bet giri? 1xbet-giris-2.com .

рулонные шторы в москве рулонные шторы в москве .

рулонные шторы на окна москва http://www.rulonnye-shtory-s-elektroprivodom7.ru/ .

one x bet http://www.1xbet-giris-4.com .

seo partner program http://www.optimizaciya-i-seo-prodvizhenie-sajtov-moskva.ru .

поисковое продвижение сайта в интернете москва поисковое продвижение сайта в интернете москва .

блог про seo блог про seo .

материалы по маркетингу http://www.statyi-o-marketinge6.ru/ .

seo partner http://optimizaciya-i-seo-prodvizhenie-sajtov-moskva-1.ru .

поисковое продвижение сайта в интернете москва поисковое продвижение сайта в интернете москва .

блог интернет-маркетинга http://www.statyi-o-marketinge7.ru/ .

digital маркетинг блог http://statyi-o-marketinge6.ru/ .

hgh bodybuilding cycle

References:

hgh and testosterone [https://www.generation-n.at/forums/Users/yachtdigger68]

hgh x2 somatropinne

References:

4Iu Hgh Reddit – https://Apunto.It/User/Profile/358624,

sytropin hgh

References:

hgh und testo kur (Exploreourpubliclands.org)

hgh cutting cycle

References:

hgh Testosterone cycle (http://www.hulkshare.com)

internetagentur seo https://optimizaciya-i-seo-prodvizhenie-sajtov-moskva-1.ru .

интернет маркетинг статьи интернет маркетинг статьи .

поисковое продвижение москва профессиональное продвижение сайтов http://optimizaciya-i-seo-prodvizhenie-sajtov-moskva.ru/ .

оптимизация сайта блог оптимизация сайта блог .

hgh injections side effects

References:

Hgh For Bodybuilding dosage (Myspace.Com)

hgh dosage cycle

References:

hgh Kur vorher nachher – doc.adminforge.de –

how many iu of hgh per day for muscle growth

References:

hgh dosierung Frauen – https://rentry.co/

–

hgh 3 months results

References:

how much Hgh to inject (graph.org)

dosage hgh bodybuilding

References:

hgh & Testosterone (oakmontforum.com)

hgh preis pro einheit

References:

hgh 3 iu per day results [able2know.org]

hgh-x2 de crazybulk y genf20

References:

hgh or testosterone for muscle (oren-expo.ru)

how much hgh should a woman take

References:

Hgh Bodybuilding Dose (http://Www.Ecccnet.Com)

hgh-x2 results

References:

hgh injections (apunto.it)

hgh hormon bodybuilding

References:

hgh cycle for muscle gain (mozillabd.science)

how much hgh to take a day

References:

hgh cycle length – https://blogfreely.net/rhythmturtle23/comment-gagner-du-muscle-avec-lhormone-de-croissance-sport-nutrition-expert,

hgh testosterone stack

References:

sytropin hgh oral supplement spray (https://forum.lexulous.com/user/twistbeet12/)

hgh vs testosterone for fat loss

References:

hgh fettverbrennung (http://cqr3d.ru/user/salmonsound20/)

how long does it take to see results from hgh

References:

long term side effects of hgh (http://masjidwasl.com/members/framepike5/activity/163649/)

how much hgh to take for bodybuilding

References:

sytropin hgh (https://iskustva.net/user/ouncewoman1)

hgh bodybuilding nebenwirkungen

References:

how much hgh should a man take [pad.karuka.tech]

hgh cycle dosage

References:

how much hgh Do Bodybuilders take (stackoverflow.qastan.Be)

hgh vs anabolic steroids

References:

testosterone and hgh Cycle (Buketik39.ru)

8 iu hgh per day

References:

hgh results pictures, http://muhaylovakoliba.1gb.ua,

anadrol vs hgh

References:

hgh testosterone stack (https://Pikidi.com/seller/profile/veilnic34)

4iu hgh reddit

References:

Hgh skin before and after (http://www.hulkshare.com)

согласование проекта перепланировки согласование проекта перепланировки .

перепланировка нежилого помещения в москве перепланировка нежилого помещения в москве .

surewin online casino http://www.surewin-online.com/ .

icebet casino icebet casino .

hgh 30000

References:

test and hgh cycle dosage – https://pad.geolab.space –

hgh-x2 de crazybulk y genf20

References:

before and after hgh pics (postheaven.net)

how much hgh should i take

References:

https://historydb.date/wiki/Humatrope_Hgh_Kaufen_Somatropin_Lilly_72_I_U_Somatotropes

hgh and testosterone

References:

https://menwiki.men/wiki/Hgh_Kaufen_Norditropin_Simplexx_Novo_Nordisk_Somatropin

Thanks for another informative website. Where else may just I get that type of info written in such a perfect method? I have a venture that I am just now working on, and I have been on the look out for such information.

1x giri? http://1xbet-7.com/ .

как согласовать перепланировку квартиры как согласовать перепланировку квартиры .

surewin slot https://www.surewin-online.com .

beep casino http://www.beepbeepcasino-online.com/ .

Hi there, I discovered your site by way of Google at the same time as searching for a comparable subject, your web site got here up, it looks good. I have bookmarked it in my google bookmarks.

valor casino valor casino .

1xbet giri?i https://www.1xbet-7.com .

помощь в согласовании перепланировки квартиры http://soglasovanie-pereplanirovki-1.ru/ .

beep beep casino pl http://beepbeepcasino-online.com .

surewin casino review https://www.surewin-online.com .

valor casino apk valor casino apk .

1xbet yeni adresi 1xbet-7.com .

согласовать проект перепланировки https://www.soglasovanie-pereplanirovki-1.ru .

beep beep casino promo codes beepbeepcasino-online.com .

sure win https://surewin-online.com .

heaps of wins no deposit codes heaps of wins no deposit codes .

курс seo http://kursy-seo-12.ru/ .

the goliath casino http://www.goliath-casino.com .

icebet casino no deposit bonus code icebet casino no deposit bonus code .

кухни на заказ в санкт-петербурге https://www.kuhni-spb-10.ru .

icebet casino login icebet casino login .

школа seo http://www.kursy-seo-12.ru/ .

goliath casino bonus http://www.goliath-casino.com/ .

icebet casino icebet casino .

учиться seo http://kursy-seo-12.ru .

it перевод цена telegra.ph/Oshibka-lokalizacii-pochemu-vash-IT-produkt-ne-ponimayut-za-granicej-11-09 .

бюро переводов в мск teletype.in/@alexd78/iF-xjHhC3iA .

it перевод услуги telegra.ph/Oshibka-lokalizacii-pochemu-vash-IT-produkt-ne-ponimayut-za-granicej-11-09 .

бюро переводов с нотариальным заверением teletype.in/@alexd78/iF-xjHhC3iA .

it переводчик цена telegra.ph/Oshibka-lokalizacii-pochemu-vash-IT-produkt-ne-ponimayut-za-granicej-11-09 .

бюро переводов в москве teletype.in/@alexd78/iF-xjHhC3iA .

plane crash game money download https://aviator-game-predict.com .

электрические гардины для штор http://prokarniz36.ru .

udhzswulowgithynkvsuskwipztvdg

карниз для штор с электроприводом elektrokarniz1.ru .

карниз с приводом http://elektrokarniz-dlya-shtor11.ru/ .

Great insights on AI in poker-tyy.AI’s directory could be a goldmine for players wanting to leverage tools like the AI SEO Assistant to refine their game strategy and content.

рулонные шторы в москве рулонные шторы в москве .

тканевые электрожалюзи http://prokarniz23.ru/ .

автоматическое открывание штор https://prokarniz23.ru .

dmrywetulvsknlzuyuoqwuffzmkodw

мелбет ру http://v-bux.ru .

chicken road melbet game http://www.kurica2.ru/uz .

написать курсовую на заказ http://kupit-kursovuyu-1.ru/ .

стоимость написания курсовой работы на заказ http://www.kupit-kursovuyu-6.ru/ .

сайт для заказа курсовых работ http://www.kupit-kursovuyu-7.ru .

курсовые заказ https://kupit-kursovuyu-8.ru .

написать курсовую на заказ написать курсовую на заказ .

aviator game aviator game .

aviator x aviator-game-winner.com .

rocket wala game https://aviator-game-deposit.com .

aviator x http://www.aviator-game-winner.com .

ремонт квартир под ключ в москве отзывы https://rejting-kompanij-po-remontu-kvartir-moskvy.com/ .

????? ??? http://aviator-game-deposit.com .

ремонтные бригады ремонтные бригады .

рулонные шторы с электроприводом на окна http://www.avtomaticheskie-rulonnye-shtory11.ru .

???? ???? ??? aviator-game-deposit.com .

ремонт квартир компании https://www.rejting-kompanij-po-remontu-kvartir-moskvy.com .

шторы автоматические avtomaticheskie-rulonnye-shtory11.ru .

рольшторы на окна купить в москве http://www.avtomaticheskie-rulonnye-shtory11.ru .

metatrader 5 download mac metatrader-5-downloads.com .

mt5 download mac https://metatrader-5-mac.com .

metatrader 5 download mac http://www.metatrader-5-downloads.com/ .

download metatrader 5 download metatrader 5 .

metatrader 5 metatrader-5-downloads.com .

download mt5 for mac https://metatrader-5-mac.com/ .

mt5 mac metatrader-5-downloads.com .

рулонные электрошторы http://www.avtomaticheskie-rulonnye-shtory11.ru/ .

forex metatrader 5 https://metatrader-5-mac.com/ .

двойные рулонные шторы с электроприводом http://www.avtomaticheskie-rulonnye-shtory11.ru/ .

download metatrader 5 http://metatrader-5-downloads.com/ .

mt5 mac download metatrader-5-mac.com .

автоматические рулонные шторы автоматические рулонные шторы .

metatrader 5 mac https://metatrader-5-downloads.com .

metatrader 5 mac metatrader 5 mac .

досудебная экспертиза залива досудебная экспертиза залива .

купить филлеры москва купить филлеры москва .

заказать курсовой проект заказать курсовой проект .

курсовые заказ курсовые заказ .

Wonderful beat ! I would like to apprentice while you amend your site, how could i subscribe for a blog site? The account aided me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright clear idea

курсовая работа купить курсовая работа купить .

заказать практическую работу недорого цены https://kupit-kursovuyu-5.ru .

написать курсовую на заказ http://kupit-kursovuyu-8.ru/ .

покупка курсовых работ https://www.kupit-kursovuyu-9.ru .

заказать курсовую работу заказать курсовую работу .

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/sk/register?ref=WKAGBF7Y

сколько стоит сделать курсовую работу на заказ http://www.kupit-kursovuyu-9.ru .

карнизы для штор купить в москве http://prokarniz36.ru .

экспертиза по заливу квартиры экспертиза по заливу квартиры .

купить филлеры оптом купить филлеры оптом .

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/en-NG/register?ref=YY80CKRN

карниз электро https://prokarniz36.ru .

оценка ущерба залив по вине управляющей компании https://ekspertiza-zaliva-kvartiry-5.ru/ .

филлер ру филлер ру .

автоматический карниз для штор https://www.prokarniz36.ru .

стоимость экспертизы залива стоимость экспертизы залива .

филлеры цена филлеры цена .

электрокарнизы цена http://www.provorota.su .

электрический карниз для штор купить elektrokarniz2.ru .

электрокарнизы цена электрокарнизы цена .

1win официальный промокод http://www.1win12043.ru

автоматические карнизы http://www.provorota.su .

электрокарниз недорого https://elektrokarniz2.ru .

карниз с приводом для штор elektrokarniz98.ru .

электрокарнизы купить в москве https://provorota.su .

карниз с электроприводом elektrokarniz2.ru .

электрокарнизы для штор купить в москве http://www.elektrokarniz98.ru .

автоматические рулонные шторы на окна rulonnye-shtory-s-elektroprivodom499.ru .

рулонные жалюзи москва рулонные жалюзи москва .

жалюзи для пластиковых окон с электроприводом https://www.prokarniz23.ru .

рулонные шторы с автоматическим управлением rulonnye-shtory-s-elektroprivodom499.ru .

рулонные жалюзи москва рулонные жалюзи москва .

жалюзи для пластиковых окон с электроприводом https://www.prokarniz23.ru .

рулонные занавески рулонные занавески .

рулонные шторы с пультом рулонные шторы с пультом .

жалюзи автоматические цена жалюзи автоматические цена .

устранение протечек в подвале gidroizolyacziya-podvala-iznutri-czena.ru .

гидроизоляция подвала цена за м2 гидроизоляция подвала цена за м2 .

инъекционная гидроизоляция подвала инъекционная гидроизоляция подвала .

покупка курсовых работ https://www.kupit-kursovuyu-22.ru .

гидроизоляция подвала цена гидроизоляция подвала цена .

экскаватор заказать цена https://arenda-ekskavatora-pogruzchika-5.ru .

инъекционная гидроизоляция вводов коммуникаций http://www.inekczionnaya-gidroizolyacziya.ru .

вода в подвале http://gidroizolyacziya-podvala-iznutri-czena.ru/ .

гидроизоляция подвала обследование gidroizolyacziya-podvala-samara.ru .

ремонт бетонных конструкций трещины ремонт бетонных конструкций трещины .

обмазочная гидроизоляция цена за работу м2 gidroizolyacziya-czena1.ru .

инъекционная гидроизоляция многоквартирный дом http://inekczionnaya-gidroizolyacziya.ru/ .

сырость в подвале многоквартирного дома [url=http://www.gidroizolyacziya-podvala-iznutri-czena.ru]http://www.gidroizolyacziya-podvala-iznutri-czena.ru[/url] .

гидроизоляция подвала снаружи цена гидроизоляция подвала снаружи цена .

гидроизоляция подвала гидроизоляция подвала .

инъекционная гидроизоляция фундамента инъекционная гидроизоляция фундамента .

усиление проёмов под панорамные окна https://usilenie-proemov2.ru .

усиление проёма швеллером усиление проёма швеллером .

написать курсовую работу на заказ в москве https://www.kupit-kursovuyu-21.ru .

студенческие работы на заказ http://www.kupit-kursovuyu-23.ru .

помощь студентам и школьникам https://kupit-kursovuyu-22.ru/ .

Hi my family member! I want to say that this post is amazing, nice written and come with almost all vital infos. I would like to look extra posts like this .

pin up jonli tikish pin up jonli tikish

pin up poker uz pin up poker uz

пин ап новый бонус https://www.pinup5011.ru

пин ап перевод через humo пин ап перевод через humo

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/de-CH/register?ref=W0BCQMF1

пин ап лайв ставки http://www.pinup5013.ru

пин ап демо режим http://www.pinup5014.ru

один вин http://1win5522.ru

Andra populära färgalternativ inkluderar svart, vitt och silver, samt skiffergrå, vilket perfekt matchar replika klockor boett i rostfritt stål.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I like your writing style genuinely enjoying this internet site.

Casino.guru sieht sich als eine unabhängige Informationsplattform

über Online Casinos und Online Casinospiele, die von keinem Glücksspielanbieter oder irgendeiner anderen Instanz kontrolliert wird.

Teilen Sie Ihre Meinung mit oder erhalten Sie Antworten auf Ihre Fragen. Er hatte wiederholt

nach seinem Spielverlauf und seiner Korrespondenz gefragt, aber keine

Unterlagen erhalten. Die Spielerin bestätigte den Erhalt ihrer

Gewinne und bedankte sich für die erhaltene Unterstützung.

So können Spieler ihre Probleme schneller lösen, ohne Support-Mitarbeiter einschalten zu müssen.

Darüber hinaus bietet die Plattform im FAQ-Bereich eine Vielzahl von Fragen und Antworten. Die responsive

Version ermöglicht den sofortigen Zugriff auf Ihre Lieblings-Casinospiele.

Sie sehen außerdem Banner und Spielecover in Form von Schiebereglern zur schnelleren Auswahl.

Unten im linken Menü befindet sich eine spezielle Schaltfläche zum schnellen Herunterladen der App.

Dank des praktischen Menüs auf der linken Seite mit Dropdown-Spiel Abschnitten finden Sie sie

leicht und können sich schnell an die Navigation gewöhnen.

References:

https://online-spielhallen.de/cashwin-casino-bonus-code-alle-details-fur-deutsche-spieler/

**aquasculpt**

aquasculpt is a premium fat-burning supplement meticulously formulated to accelerate your metabolism and increase your energy output.

**backbiome**

backbiome is a naturally crafted, research-backed daily supplement formulated to gently relieve back tension and soothe sciatic discomfort.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**aquasculpt**

aquasculpt is a revolutionary supplement crafted to aid weight management by naturally accelerating metabolism

**hepatoburn**

hepatoburn is a high-quality, plant-forward dietary blend created to nourish liver function, encourage a healthy metabolic rhythm, and support the bodys natural fat-processing pathways.

**vivalis**

vivalis is a premium natural formula created to help men feel stronger, more energetic, and more confident every day.

**alpha boost**

alpha boost for men, feeling strong, energized, and confident is closely tied to overall quality of life. However, with age, stress, and daily demands

**nitric boost**

nitric boost is a daily wellness blend formulated to elevate vitality and support overall performance.

**synadentix**

synadentix is a dental health supplement created to nourish and protect your teeth and gums with a targeted combination of natural ingredients

**nervecalm**

nervecalm is a high-quality nutritional supplement crafted to promote nerve wellness, ease chronic discomfort, and boost everyday vitality.

Montags bis donnerstags können Sie bis 3 Uhr morgens spielen,

freitags und samstags sogar bis 5 Uhr. In den zwölf Jahren seit der Eröffnung wurden im Grand

Casino Basel schon sechzehn Personen an den Glücksspielautomaten zu Millionären. Mit

über 357 Glücksspielautomaten, 15 Spieltischen,

3 Bars, 2 Restaurants und einem Eventsaal und dem einzigartigen Hotel ist Abwechslung 100% garantiert.

Die Firma Grand Casino Basel, ansässig an der Adresse Flughafenstrasse 225, 4056 Basel

BS, ist im Branchenbuch von gelistet.

In Basel St.Johann, direkt am Flughafen und in nächster Nähe zur

Grenze nach Frankreich, befindet sich die Spielbank Basel.

Bonus und Freispiel Angebote ohne Einzahlung Eine Besonderheit ist das winddynamische Werk, welches vom eingebauten Spieltisch aus anspielbar ist.

Die Silvesterkonzerte im Musiksaal werden seit 1996 vom damals gegründeten Basler Festival Orchester gespielt.

Die immense Schuldenlast durch das übernommene Sommercasino konnte jedoch nicht bewältigt werden und so wurde das Sommercasino samt Park

1937 verkauft. Da sich die Sommercasino-Gesellschaft sich in den folgenden Jahrzehnten zunehmend verschuldete, während das Stadtcasino

erblühte, wurden 1907 die beiden Gesellschaften fusioniert.

References:

https://online-spielhallen.de/fresh-casino-login-ihr-weg-ins-spielvergnugen/

**yusleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear

1win android yuklab olish https://www.1win5511.ru

**glycomute**

glycomute is a natural nutritional formula carefully created to nurture healthy blood sugar levels and support overall metabolic performance.

**balmorex**

balmorex is an exceptional solution for individuals who suffer from chronic joint pain and muscle aches.

**prodentim**

prodentim is a distinctive oral-care formula that pairs targeted probiotics with plant-based ingredients to encourage strong teeth

**mindvault**

mindvault is a premium cognitive support formula created for adults 45+.

**glpro**

glpro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

**vitrafoxin**

vitrafoxin is a premium brain enhancement formula crafted with natural ingredients to promote clear thinking, memory retention, and long-lasting mental energy.

**provadent**

provadent is a newly launched oral health supplement that has garnered favorable feedback from both consumers and dental professionals.

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**femipro**

femipro is a dietary supplement developed as a natural remedy for women facing bladder control issues and seeking to improve their urinary health.

пин ап живое казино https://pinup5015.ru

**tonic greens**

tonic greens is a cutting-edge health blend made with a rich fusion of natural botanicals and superfoods, formulated to boost immune resilience and promote daily vitality.

**vertiaid**

vertiaid is a high-quality, natural formula created to support stable balance, enhance mental sharpness, and alleviate feelings of dizziness

**sleep lean**

is a US-trusted, naturally focused nighttime support formula that helps your body burn fat while you rest.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity

**prostavive**

prostavive Maintaining prostate health is crucial for mens overall wellness, especially as they grow older.

**primebiome**

The natural cycle of skin cell renewal plays a vital role in maintaining a healthy and youthful appearance by shedding old cells and generating new ones.

**gluco6**

gluco6 is a natural, plant-based supplement designed to help maintain healthy blood sugar levels.

Alright, gk88slot, you got my attention. The variety of slots here is HUGE. Plus, the interface is pretty smooth. Thumbs up from me! Give it a try gk88slot

1win virtual sport 1win virtual sport

**oradentum**

oradentum is a comprehensive 21-in-1 oral care formula designed to reinforce enamel, support gum vitality, and neutralize bad breath using a fusion of nature-derived, scientifically validated compounds.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

1вин мобильное приложение уз https://www.1win5513.ru

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

скачать мелбет на андроид украина melbet5001.ru

1win efirda ko‘rish http://1win5514.ru

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/it/register-person?ref=P9L9FQKY

They are the bridge between players and the casino, handling queries, resolving issues, and providing assistance around the clock.

They are the unsung heroes who ensure a smooth and

enjoyable gaming experience for every player. Additionally,

reading reviews and testimonials from other players can give you an idea of

the overall customer satisfaction with a

particular casino’s support team. Look for casinos offering 24/7 support through various channels,

including live chat, email, and phone, to promptly resolve any

issues you might encounter. These offers enhance your gaming

experience and increase your chances of winning.

The best Australian online casino offer a wide variety of

casino bonuses to attract and reward players. In summary, our curated selection of the finest online

casinos in Australia offers an exceptional range

of gaming options, including the much-loved pokies. The online casinos

that they license have to undergo rigorous testing to

ensure their games are fair, and they must abide by international player-protecting laws.

The best online casinos in Australia offer these bonuses in percentages.

To find the best bonuses and play various games, you can sign up

at the top online gambling sites

recommended. To conduct our extensive study, we actively participate in gambling communities and gather input from

players regarding their encounters with online casinos.

SkyCrown Casino consists of a ten-level VIP Club players climb

through by earning points for placing bets.

During exclusion, marketing communications cease immediately, and the player cannot

create new accounts through verification systems that detect duplicate registrations.

Players enjoy minimal latency regardless of connection speed, preserving the

authentic atmosphere that makes live dealer games increasingly popular among discerning casino enthusiasts.

Furthermore, we recommend you try out the Instant play feature if you are playing from your mobile device.

Every Thursday, the qualifying customers will get a cashback bonus of up to 1,000 USDT with

no additional wagering requirements. Keep a check on the promotion page of the Sky Crown website or visit our promotional

page for Sky Crown Casino’s latest bonus promo codes.

Offering two welcome packages, and plenty of other weekly/special promos, you will always

have the chance to increase your casino bankroll. A brilliantly designed website, the navigation tools on the homepage or throughout the site enhance the overall

experience. In addition, you will also find slots from mid-size software companies that are emerging

and offering smooth and fair gameplay.

References:

https://blackcoin.co/2_top-5-high-roller-online-casinos_rewrite_1/

Whether you’re looking to play a quick game of Skribbl.io, Happy Wheels, or

Flappy Bird, this list ensures you have a consistent gaming experience without interruptions.

These unblocked games are accessible from

most devices, including school and work computers. By bookmarking these backup

links, you ensure you always have access to an alternative

gaming platform when your usual sites are blocked. All of the links below

are regularly updated to ensure they remain unblocked, giving you uninterrupted gaming sessions.

Whether you’re into action-packed games,

puzzles, strategy games, or just looking for a fun distraction, this list has

you covered.

These backup links provide access to various game sites that are not blocked by

most network filters. If you love playing unblocked games at school or work but often run into restrictions or

blocked websites, you know how frustrating it can be. Whether

you’re looking to enjoy these classic games or learn from their code, this collection has something for everyone!

This repository contains a collection of classic mini-games developed in Python, including games

like Tic-Tac-Toe, Snake, and more. Scrape nxbrew to automatically download Switch games These tools are

helpful with cracking your own games.

Repacks are highly compressed game downloads, designed for people with slow/limited internet bandwidth.

And now, on with the game-hacking goodness! OpenSpiel is a collection of environments and algorithms for

research in general reinforcement learning and search/planning in games.

Play your favorite games in a borderless window;

no more time consuming alt-tabs.

References:

https://blackcoin.co/hobarts-home-of-entertainment-the-ultimate-casino-experience/

The casino is committed to delivering a vast portfolio of games from premium providers, along with generous multi-tier welcome bonuses

and instant cryptocurrency withdrawals. Level

Up Casino was founded in 2020 by experienced operator

Dama N.V., with a mission to provide a modern and secure online gaming experience for its players.

To give its players access to the best and most recent casino games, LevelUp Casino collaborates

with a number of software developers.

I was pleased by the multi-tier bonus system, which incentivizes players to make

deposits to earn free spins and bonus funds. They make sure that a good casino

experience is achieved while putting the expectations of players as well as the ease

when using the interface into consideration. Again, for the players’ convenience, there will always be a friendly team

of specialists available at any time and any

day through email or chat.

References:

https://blackcoin.co/aussie-casinos-australias-largest-online-casino-database/

**biodentex**

biodentex is a dentist-endorsed oral wellness blend crafted to help fortify gums, defend enamel, and keep your breath consistently fresh.

online slots uk paypal

References:

http://girl.naverme.com/bbs/board.php?bo_table=free&wr_id=138138

online casino paypal einzahlung

References:

https://blogs.koreaportal.com/bbs/board.php?bo_table=free&wr_id=7110127

paypal casinos for usa players

References:

https://jobotel.com/companies/online-casino-mit-paypal-sicher-schnell-einzahlen-2025/

casinos online paypal

References:

https://bio.rocketapps.pro/gladisrasc

online betting with paypal winnersbet

References:

https://fmagency.co.uk/companies/best-paypal-casinos-2025-100-real-money-paypal-sites-%ef%b8%8f/

online casino accepts paypal us

References:

https://fmagency.co.uk/companies/us-online-casinos-that-accept-paypal-2025/

online casino australia paypal

References:

https://unidemics.com/employer/brand-new-online-us-casinos-in-december-2025/

australian online casinos that accept paypal

References:

https://www.lms.pidernegi.org/employer/best-online-casinos-in-australia-2025-instant-withdrawal-casinos/

best online casino usa paypal

References:

https://robbarnettmedia.com/employer/best-online-casinos-in-australia-top-real-money-casinos-in-2025/

casino mit paypal einzahlung

References:

https://australiaremotejob.com/employer/best-new-online-casinos-australia-2025-recently-launched/

**wildgut**

wildgut is a precision-crafted nutritional blend designed to nurture your dogs digestive tract.

paypal online casinos

References:

https://oportunidades.talento-humano.co/employer/online-casinos-that-accept-paypal-usa-high-5-casinos/

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/da-DK/register-person?ref=V3MG69RO

**mitolyn**

mitolyn is a plant-forward blend formulated to awaken metabolic efficiency and support steady, sustainable weight management.

online casino with paypal

References:

https://clicknaukari.com/employer/200-trusted-sites-reviewed-pokies-guide/

**prostadine**

prostadine concerns can disrupt everyday rhythm with steady discomfort, fueling frustration and a constant hunt for dependable relief.

Needed something quick and easy so I tried mbetapp. Works like a charm! Saved me a bunch of time. You should check out mbetapp

online casino mit paypal einzahlung

References:

https://laboryes.com/employer/online-casino-sites-in-australia-december-2025/

casino online paypal

References:

https://eduxhire.com/employer/paypal-casinos-best-online-casinos-that-accept-paypal/

оне вин https://1win12045.ru/

**ignitra**

ignitra is a premium, plant-based dietary supplement created to support healthy metabolism, weight management, steady energy, and balanced blood sugar as part of an overall wellness routine

melbet apk télécharger gratuit http://melbet5006.ru/

скачать мостбет кз http://www.mostbet2029.help

Big fan of ‘gà chọi c1’ here! Hoping to find some good matches on this site. Check out gà chọi c1.

mostbet. mostbet2031.help

Rey Lucky Casino, sounds intriguing. Haven’t heard much about it, but that King Lucky vibe is pretty appealing. I’d probably recommend checking it out. See if it’s your lucky day. Explore it here: reyluckycasino

Cwinsgame is alright, has a solid selection of games. Not my favorite site, but it’s reliable and works on different devices. Check it out yourself! Right here: cwinsgame

**finessa**

Finessa is a natural supplement made to support healthy digestion, improve metabolism, and help you achieve a flatter belly.

mostbet букмекерская контора сайт https://www.mostbet2030.help

**neurosharp**

neurosharp is a next-level brain and cognitive support formula created to help you stay clear-headed, improve recall, and maintain steady mental performance throughout the day.

Legale Online Casinos sind lizenziert und unterliegen strengen Regulierungen, die den Spielerschutz, sichere Auszahlungen und Datenschutz sicherstellen. Seit dem Glücksspielstaatsvertrag 2021 dürfen Anbieter eine deutsche Lizenz erhalten, wenn sie die strengen Vorgaben der Behörden erfüllen. Setze dir zunächst ein klares Budget und spiele verantwortungsbewusst, um Verluste zu begrenzen. In Deutschland unterliegen lizenzierte Anbieter strengen Vorgaben, die auch den Support betreffen. Oft gibt es für App-Nutzer besondere Extras wie Freispiele o.Ä.. Native Casino Apps für iOS und Android bieten beispielsweise u.a. Bei den meisten Online Casinos gehören mobile Webseiten bereits zum Standard-Repertoire, native Apps bieten allerdings noch nicht alle an.

Als eines der führenden Casino-Vergleichsportale in Deutschland versorgen wir Dich mit allen notwendigen Informationen, um sicher den besten Glücksspielanbieter auszuwählen. Wir bieten dir tiefgehende Einblicke und verlässliche Informationen zu diesen Schlüsselthemen. Anmeldungen bei Casinos mit einer Lizenz aus anderen Jurisdiktionen sind für deutsche Spieler nicht gestattet. Die Lizenz erlaubt keine Jackpots, beschränkt Zahlungsmethoden und schließt derzeit Live Casino- und Tischspiele aus.

References:

https://s3.amazonaws.com/new-casino/best%20online%20casino.html

I’ve been playing on abc8casino for a little minute. Definitely worth a try. Site looks pretty nice! And so far so good. abc8casino

Anyone tried vvvwin129? I’m curious. Trying to see if it’s legit before I deposit anything. Let me know if you’ve had any experiences! 🤔

мостбет регистрация мостбет регистрация

mostbet website http://mostbet2033.help/

1win official https://1win3001.mobi

References:

Anavar 20mg before and after

References:

http://ezproxy.cityu.edu.hk/login?url=https://candy96.fun

1win registration https://1win3002.mobi/

1win poker uz 1win poker uz

1win demo rejim 1win demo rejim

промокоды на 1win http://1win12046.ru/

With havin so much written content do you ever run into any problems of plagorism or copyright infringement? My website has a lot of completely unique content I’ve either created myself or outsourced but it appears a lot of it is popping it up all over the web without my agreement. Do you know any ways to help protect against content from being stolen? I’d genuinely appreciate it.

1win сайт скачать http://1win12047.ru/

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/register?ref=IXBIAFVY

What a joke of a game. Played on mr v at 25p a go for £100…only kept playing thinking it would eventually pay a bonus. This game has cost me over £500 in 4 days and had no bonus. How dare the blame be put on the individual when every other ad is a gambling site. The range of bets on the site we tested ran from a minimum bet per spin of $ £ €0.20 up to a maximum of $ £ €100 per spin. He has scanned the Internet for licensed casinos offering their players the highest-paying RTP version of Gates of Olympus. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Whether you’re a fan of Greek mythology or just love high-volatility action, the Gates of Olympus game offers the perfect mix of visual drama and win potential. From base game cascades to multiplier-charged free spins, every moment feels epic.

https://aliftechs.ca/casino/uk-1win-casino-lounge-australian-player-review/

Basic Game Info This is a superb slot whether you add Christmas to it or not, but now you at least have the option to enhance the Xmas feel when you want to play one of your favourite slots by firing up Gates of Olympus Xmas 1000. In summary, the Gates of Olympus Xmas 1000 slot is like its predecessor but with a festive twist. Pragmatic Play has gone on to release Gates of Olympus Super Scatter which comes with a Super Scatter symbol. If they land in a combination of 4+ scatters of any kind, a bet multiplier prize will be award, up to 50,000 times your total bet. In summary, the Gates of Olympus Xmas 1000 slot is like its predecessor but with a festive twist. Pragmatic Play has gone on to release Gates of Olympus Super Scatter which comes with a Super Scatter symbol. If they land in a combination of 4+ scatters of any kind, a bet multiplier prize will be award, up to 50,000 times your total bet.

**herpafend**

herpafend is a natural wellness formula developed for individuals experiencing symptoms related to the herpes simplex virus.

**neurosharp**

neurosharp is a next-level brain and cognitive support formula created to help you stay clear-headed, improve recall, and maintain steady mental performance throughout the day

**aqua sculpt**

aquasculpt is a premium metabolism-support supplement thoughtfully developed to help promote efficient fat utilization and steadier daily energy.

**vivalis**

vivalis is a premium, plant-forward supplement created to help support mens daily drive, self-assurance, and steady energy.

**alpha boost**

For men, feeling strong, energized, and confident is closely tied to overall quality of life. However, with age, stress, and daily demands

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

**zencortex**

zencortex Research’s contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**mitolyn**

mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

**ignitra**

ignitra is a thoughtfully formulated, plant-based dietary supplement designed to support metabolic health, balanced weight management, steady daily energy, and healthy blood sugar levels as part of a holistic wellness approach.

**back biome**

back biome is a naturally crafted, research-backed daily supplement formulated to gently relieve back tension and soothe sciatic discomfort.

**gl pro**

gl pro is a natural dietary supplement formulated to help maintain steady, healthy blood sugar levels while easing persistent sugar cravings. Instead of relying on typical drug-like ingredient

**provadent**

provadent is a recently introduced oral wellness supplement thats been receiving positive attention from everyday users as well as dental experts.

**nitric boost**

nitric is a daily wellness formula designed to enhance vitality and help support all-around performance.

**gluco tonic**

gluco tonic is an expertly formulated dietary supplement designed to help maintain balanced blood sugar levels naturally.

1win code bonus http://1win5741.help

**finessa**

finessa is a natural supplement made to support healthy digestion, improve metabolism, and help you achieve a flatter belly. Its unique blend of probiotics and nutrients works together to keep your gut balanced and your body energized

**biodentex**

biodentex is an advanced oral wellness supplement made for anyone who wants firmer-feeling teeth, calmer gums, and naturally cleaner breath over timewithout relying solely on toothpaste, mouthwash, or strong chemical rinses.

**purdentix**

purdentix is a dietary supplement formulated to support oral health by blending probiotics and natural ingredients.

**nervecalm**

nervecalm is a high-quality nutritional supplement crafted to promote nerve wellness, ease chronic discomfort, and boost everyday vitality.

1win withdrawal time 1win5740.help

References:

Sol casinos

References:

https://rentry.co/knufcfn7

What’s Taking place i’m new to this, I stumbled upon this I’ve found It absolutely helpful and it has aided me out loads. I’m hoping to contribute & aid other customers like its aided me. Good job.

1win az promo kod https://1win5761.help

References:

Suncoast casino las vegas

References:

https://gpsites.stream/story.php?title=wd-40-casino-review-expert-player-ratings-2026

**prodentim**

prodentim is a distinctive oral-care formula that pairs targeted probiotics with plant-based ingredients to encourage strong teeth, comfortable gums, and reliably fresh breath.

1win qeydiyyat bonusu https://www.1win5760.help

**revitag**

revitag is a daily skin-support formula created to promote a healthy complexion and visibly diminish the appearance of skin tags.

the best steroid stack

References:

http://volleypedia.org/index.php?qa=user&qa_1=actpasta82

steroids with least side effects

References:

https://gaiaathome.eu/gaiaathome/show_user.php?userid=1806076

**blood armor**

BloodArmor is a research-driven, premium nutritional supplement designed to support healthy blood sugar balance, consistent daily energy, and long-term metabolic strength

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.info/cs/register?ref=OMM3XK51

**mounjaboost**

MounjaBoost next-generation, plant-based supplement created to support metabolic activity, encourage natural fat utilization, and elevate daily energywithout extreme dieting or exhausting workout routines.

**men balance**

MEN Balance Pro is a high-quality dietary supplement developed with research-informed support to help men maintain healthy prostate function.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

Yo, 78winlive is pretty solid! Been kicking around there for a bit, and the games are decent. Worth checking out if you’re looking for a new spot. 78winlive

Just logged into q88dangnhap the other day. The interface is clean, and navigating is a breeze. Give q88dangnhap a shot! q88dangnhap

Alright, alright, alright… okkingbet! Had some good luck there recently. Lots of options and pretty smooth overall. Highly recommend okkingbet okkingbet

References:

Pictures of before and after using anavar

References:

https://matkafasi.com/user/raypain3

References:

Test and anavar cycle before and after pictures

References:

http://okprint.kz/user/fridaysnow9/

legal steroids for sale usa

References:

https://chessdatabase.science/wiki/How_to_Increase_Testosterone_Naturally_10_Ways

References:

Before and after anavar female

References:

https://instapages.stream/story.php?title=anavar-and-winstrol-cycle-maximize-cutting-results-and-lean-muscle-gains-safely

winstrol pills for sale

References:

https://zenwriting.net/violafield4/analisis-y-comparativa-las-mejores-pastillas-de-testosterona-para-mejorar-tu

References:

Taking anavar before and after

References:

https://healy-walton-2.blogbright.net/resultats-anavar-avant-apres-comment-optimiser-votre-cycle

crazy mass testosterone max

References:

https://morphomics.science/wiki/Top_10_Test_VergleichosteronBooster_Test_Vergleich

References:

Anavar before and after female pictures

References:

https://www.garagesale.es/author/repairjeff6/

anabolic steroids are primarily used in an attempt to

References:

https://able2know.org/user/israelpump67/

References:

Anavar gains before and after

References:

https://nephila.org/members/leadprose5/activity/1126146/

References:

Nars casino bronzer

References:

https://md.inno3.fr/s/JBMJEQd3y

References:

Real money online poker

References:

https://gpsites.win/story.php?title=candy-crush-soda-saga-online-spiele-auf-king-com

References:

William hill uk login

References:

https://xn--41-4lcpj.xn--j1amh/user/clefweek09/

References:

Anacortes casino

References:

https://www.bitspower.com/support/user/taiwanpatch29

References:

Online casino slots

References:

https://escatter11.fullerton.edu/nfs/show_user.php?userid=9535067

References:

Blackjack betting strategy

References:

https://historydb.date/wiki/Claim_Your_Bonus

References:

Club player casino

References:

https://opensourcebridge.science/wiki/Cdigo_bonificacin_bet365_para_Espaa_HISPVIP_vlido_en_enero_2026

References:

Southpoint casino las vegas

References:

https://onlinevetjobs.com/author/nutcollar5/

References:

Online blackjack for money

References:

https://hubbard-saunders-2.blogbright.net/servtec-servicio-tecnico-candy-en-madrid

References:

Virtual roulette

References:

https://socialbookmark.stream/story.php?title=96-com-1-trusted-online-casino-sports-and-crypto-betting-site

References:

Chuzzle game

References:

https://bookmarkfeeds.stream/story.php?title=regarder-candy-candy-saison-1-episode-96-streaming-complet

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/register?ref=IHJUI7TF

References:

Bet365 casino

References:

https://schwanger.mamaundbaby.com/user/grousepaint43

References:

Craps fire bet

References:

https://gratisafhalen.be/author/ravenfork1/

anabolic energy reviews

References:

https://bookmarkingworld.review/story.php?title=los-5-mejores-potenciadores-de-la-testosterona-segun-la-ciencia

%random_anchor_text%

References:

https://cameradb.review/wiki/Testosteron_steigern_Die_11_besten_Tipps

what is the definition of anabolic steroids

References:

https://historydb.date/wiki/Qui_peut_prescrire_lhormone_de_croissance_Dcouvrez_les_Secrets

%random_anchor_text%

References:

https://www.divephotoguide.com/user/virgofifth40

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

dbol reviews bodybuilding|acybgnrqsav7_irjao9rzq7e7r5t8l7yoq:***

References:

https://socialbookmarknew.win/story.php?title=15-alimentos-para-aumentar-la-testosterona

will one cycle of testosterone hurt you

References:

https://justbookmark.win/story.php?title=comparatif-des-meilleurs-draineurs-minceur-efficaces-en-pharmacie-trouvez-le-produit-parfait-pour-votre-silh

anvarol amazon

References:

https://squareblogs.net/securegemini75/farmaci-per-dimagrire

guys on steroids before and after

References:

https://bookmarkstore.download/story.php?title=testosterone-cose-a-cosa-serve-e-come-aumentarlo

prices of steroids

References:

https://md.chaosdorf.de/s/n8eo4hIMkI

References:

Four winds casino michigan

References:

https://needlinda93.werite.net/online-engagement-for-australia

References:

Silver slipper casino

References:

https://gamesgrom.com/user/beaverlegal89/

References:

Live blackjack

References:

https://historydb.date/wiki/Lucky_Larrys_Lobstermania_2_Slot_Play_it_for_Free_Online

References:

Alea casino nottingham

References:

http://historydb.date/index.php?title=thorsenparrott0980

References:

Hardrock casino tampa

References:

https://opensourcebridge.science/wiki/Candy96_Casino_Australia_800_Welcome_Bonus_160_Free_Spins_Bundle

References:

Net casino

References:

http://www.aaisalearns.ca/users/storyflame59/

References:

Sugarhouse casino

References:

https://chessdatabase.science/wiki/400_No_Deposit_Bonus_2026

References:

Hollywood casino west virginia

References:

http://ask.mallaky.com/?qa=user/fuelrepair3

side effects of steroids for women

References:

https://mapleprimes.com/users/crimechief2

bodybuilding.com 10 percent off 2018

References:

https://swapon.co.in/user/profile/362809

what does anabolic steroids do to your body

References:

https://digitaltibetan.win/wiki/Post:La_terapia_con_testosterona_TRT_debe_aplicarse_cuando_hay_una_deficiencia_clara_y_no_un_simple_descenso

legal steroids alternatives

References:

https://morphomics.science/wiki/Comprar_trembolonas_Trembolonas_a_la_venta_en_STERO_is

**mounja boost**

MounjaBoost is a next-generation, plant-based supplement created to support metabolic activity, encourage natural fat utilization, and elevate daily energywithout extreme dieting or exhausting workout routines.

References:

Genting casino manchester

References:

https://historydb.date/wiki/Log_in_888casino

References:

Mill casino

References:

https://md.ctdo.de/s/ABjVoegu0C

References:

Russian roulette online game

References:

https://www.udrpsearch.com/user/turretdust8

References:

Monte casino south africa

References:

https://patterson-petterson.hubstack.net/100-freispiele-ohne-einzahlung-100-free-spins-january-2026

References:

Genting casino newcastle

References:

https://www.repecho.com/author/numbersleet3/

References:

Lumiere casino st louis

References:

https://www.pathofthesage.com/members/numbergauge8/activity/761398/

References:

Cherokee casino roland

References:

https://www.askocloud.com/index.php/user/truckkaren75

моней икс промокоды t.me/moneyx_tg .

money x бонусы t.me/moneyx_tg .

References:

Casino soundtrack

References:

http://king-wifi.win//index.php?title=shapirocarlsson9147

References:

Aquarius casino laughlin

References:

https://www.hulkshare.com/cupbush58/

мани икс зеркало t.me/moneyx_tg .

References:

Top poker players

References:

https://humanlove.stream/wiki/X3000_Casino_Sports_Betting_App

is tribulus a steroid

References:

https://hedge.fachschaft.informatik.uni-kl.de/s/o1T4x-wnL

side effects of prescribed steroids

References:

https://stokes-castro.thoughtlanes.net/can-you-take-winstrol-and-anavar-together-benefits-risks

street name for steroids

References:

https://platform.joinus4health.eu/forums/users/singermeat95/

References:

Casino 365

References:

https://porchspring55.werite.net/list-of-all-225-online-betting-sites-australia-updated-weekly